a better debit card experience is now available!

a better debit card experience is now available!

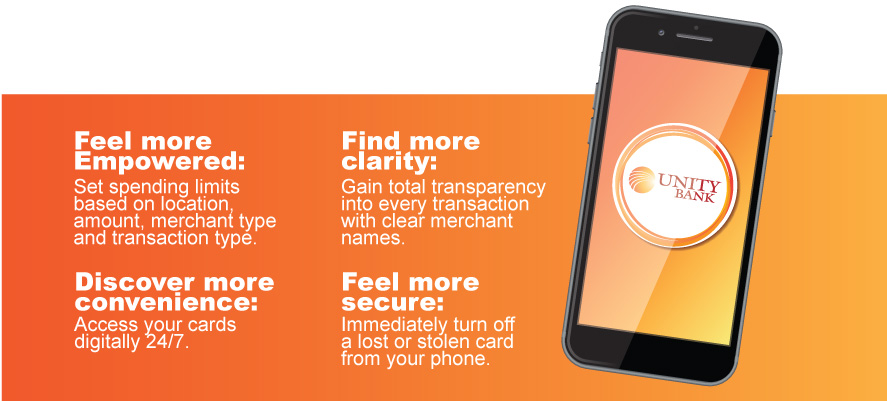

More power.

More peace of mind.

All on our Mobile Banking app.

We have launched an all-new card management experience that offers more control of your cards than ever before, right from our Mobile Banking app.

Greater Card Protection

Our card controls offer more protection than ever, allowing you to lock and unlock your cards and limit transactions by location, merchant, and transaction type. You can report lost or stolen cards from the app and set up alerts to stay informed about how your card is used.

Enhanced Insights

Our handy list of subscriptions and who has your card on file gives you a clear picture of where your money is going. Easy to read graphs make understanding your spending habits simple, and details such as merchant names, logos, and contact information give you greater insight into your card transactions.

Ultimate Convenience

Get cash without your card, easily set travel plans to ensure your card is not declined, and even access your new card before receiving it in the mail. Plus, self-service options give you 24/7 assistance without calling a service number.

Get Started

If you are new to Mobile Banking, simply download our Mobile Banking app today!

If you are a current Mobile Banking app user, you may experience a momentary delay when accessing our Mobile Banking app to allow for the updates to take effect on your mobile device. Once loaded, simply tap “My Cards” to access all the exciting new features.

Apple and the Apple logo are trademarks of Apple Inc, registered in the U.S. and other countries. App store is a service mark of Apple Inc. Android, Google Play, and the Google Play logo are trademarks of Google Inc.